Resource Center

Stay in the know with the latest news and expert insights from StartSmart Counsel. Our dedicated team of advisors regularly shares valuable updates, industry trends, and business wisdom to help you navigate the entrepreneurial journey. Explore our curated collection of news articles and blog posts to gain valuable insights and stay ahead in your startup endeavors.

Professional Services Firms Don’t Fail from Bad Work — They Fail from Unmanaged Legal Risk

A professional services firm delivers quality work. The client still sues. Why? Ambiguous scope, undocumented changes, and unlimited liability exposure.

For consultants, agencies, and advisory firms, legal risk rarely comes from incompetence—it comes from poor risk allocation.

Your ‘Standard’ SaaS Customer Agreement Is Quietly Killing Enterprise Deals — Here’s How to Fix It Before It Costs You Real Revenue

Early-stage SaaS companies often treat customer agreements as boilerplate. But once you sell into larger customers—especially regulated or security-sensitive enterprises—your contract becomes a gating item for revenue, valuation, and scale.

Choosing the Wrong Entity Can Block Your Exit: A Founder’s Guide to Getting Formation Right the First Time

Most founders think entity formation is a filing problem. It’s not. It’s a strategy decision that quietly shapes taxes, fundraising leverage, governance, and even whether your company is acquirable.

The wrong entity choice doesn’t usually hurt right away. It shows up later—when investors insist on restructuring, when equity grants get messy, or when a buyer flags your cap table as a deal risk.

Fundraising Without Regret: Legal Mistakes That Follow Founders for Years

Raising capital feels like winning. Term sheets, investor interest, wires hitting the account—it’s a rush. But some fundraising decisions age poorly.

We regularly see founders years later dealing with messy cap tables, blocked exits, or unhappy investors because of early legal shortcuts made under pressure.

Let’s talk about the most common fundraising mistakes—and how to avoid raising money you’ll later regret.

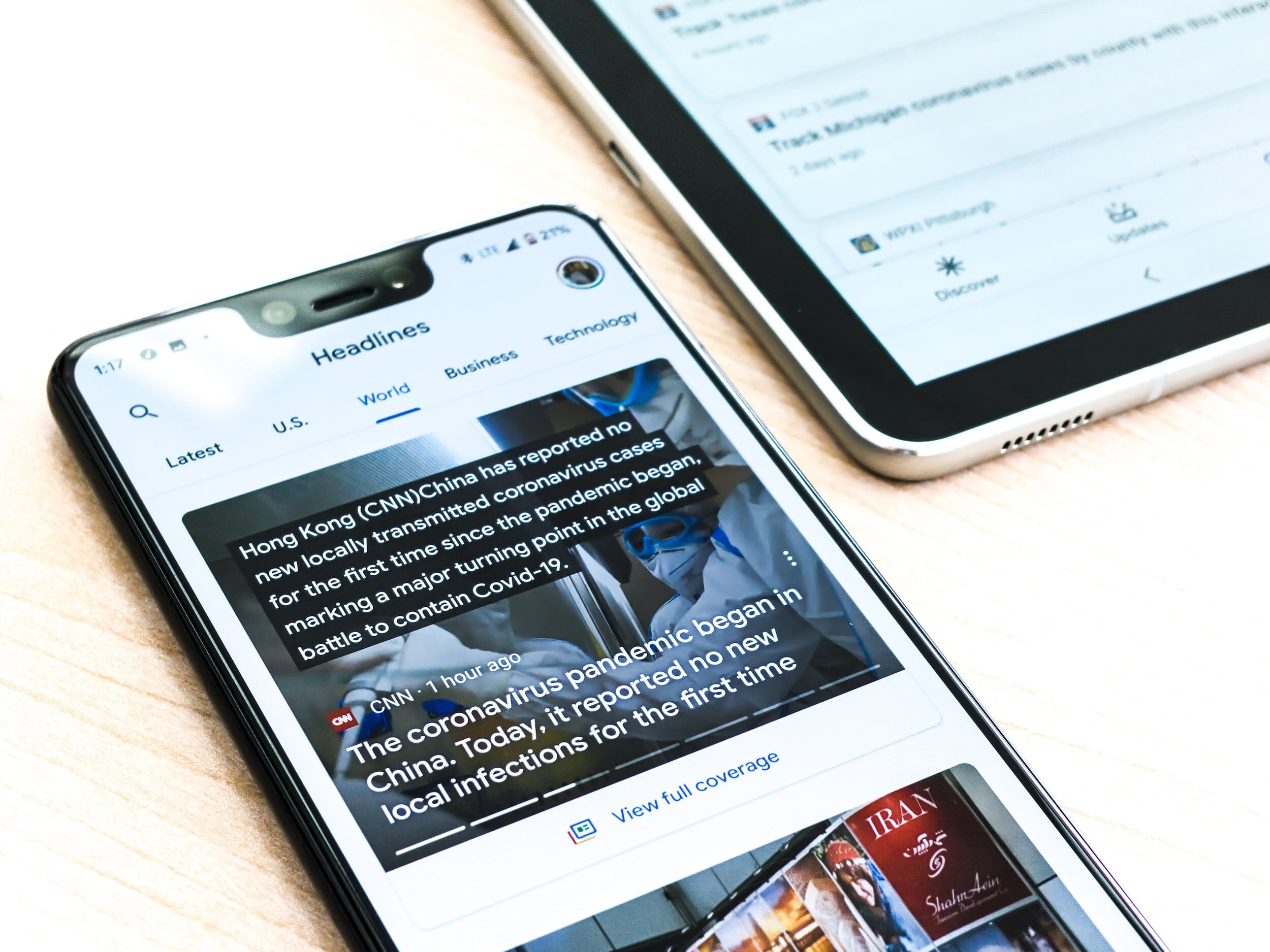

When Business Relationships Break: Red Flags You Shouldn’t Ignore

Business disputes rarely explode out of nowhere. They simmer.

Missed emails. Vague promises. Payments that slip from “late” to “uncertain.” Most disputes give off warning signs long before lawyers get involved.

The smartest move isn’t winning the fight—it’s avoiding it when possible.

The Contract Stack Every Startup Needs (Before Things Get Awkward)

Most startup disputes don’t start with bad intentions. They start with, “We’ll deal with that later.” Later, of course, is when money is on the table, expectations are misaligned, and memories suddenly differ.

Contracts aren’t about mistrust. They’re about clarity. And for early-stage companies, having the right contracts—early—can be the difference between scaling smoothly and spending your momentum on damage control.

Below is the practical contract stack every startup and small business should consider before things get awkward.

Raising Capital Without Losing Control: What Founders Miss

Raising capital feels like validation. Someone believes in your idea enough to write a check.

But too many founders focus on getting funded and not enough on what they’re giving up to do it.

Loss of control rarely happens in one dramatic moment. It happens clause by clause.

Book a Call Today!

Want to learn more? Schedule a consultation with one of our attorneys today.